am i taxed on stock dividends

This reduces exposure to capital gains taxes. Most ETFs pay dividends.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

As a result stock trading is kept to a minimum.

. Stock Dividends A stock dividend is not taxable for Pennsylvania personal income tax purposes. In contrast holding VYM in a taxable investment account means paying income taxes on the dividends paid. Explained - How stock market gains are taxed and how to declare them in your ITR Filing - Step by step guide from expert Under the income tax act 1961 the taxability of gains relied on factors like holding period and volume of transactions.

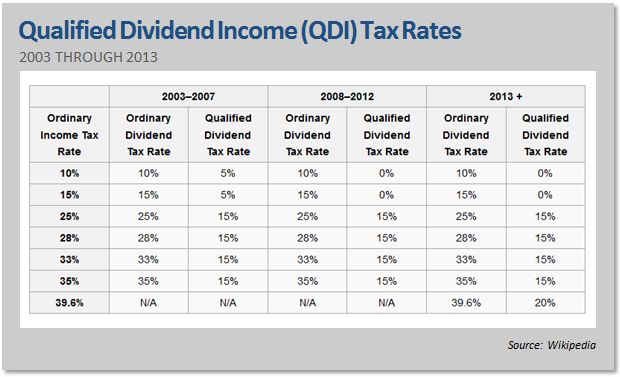

Most of us would pay 15 or 20 tax on qualified dividends. The treaty requires 15 tax withholding on dividends and 10 tax withholding on interest. Reinvesting the dividends that you earn from your investments is an excellent way to grow your portfolio without dipping into your wallet.

So if you own a US. Dividends from NLY would be taxed at the same rate as. VYM is a passively managed index fund.

A stock dividend is a pro rata distribution by a corporation to its stockholders in the form of stock if the distribution is not treated as income for federal income tax purposes. Dividends and DRIPs. Fortunately dividends receive preferential tax treatment.

Find out why dividends are not considered passive income and why some dividends are subject to a reduced tax rate based on the duration of stock ownership. You can choose to have your ETF dividends paid to you as cash or you can choose to have them automatically reinvested through a dividend reinvestment. While mutual funds have made dividend reinvestment easy.

They are taxed at lower rates than ordinary income. Stock as a Canadian resident there will be 15 withholding tax on any dividends earned. Qualified dividends are taxed at 0 if the taxpayers tax rate is 10 or 15.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

What S Your State S Dividend Income Tax Thinkadvisor

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Calculation Of Ltcg Tax On Sale Of Shares Equity Mutual Fund Units 10 Ltcg Tax On Sale Of Stocks Equity Mutual Funds Budge Budgeting Mutuals Funds Equity

Your Financial Advisor Is Wrong About Reit And Bdc Dividends Seeking Alpha

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Investment Accounts

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Structure Business Investment

How To Pay No Tax On Your Dividend Income Retire By 40

The Ultimate 5 Step Guide To Maximizing Your Index Etf Returns Young And Thrifty Trade Finance Business Finance Finance Goals

3 Dividend Stocks To Buy Now Robinhood Portfolio Update Dividend Stocks Budget Help Dividend

Is Panama A Tax Haven For You It Could Be So Learn Some Facts Tax Haven Tax Time Private Limited Company

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Dividend Tax Rates In 2021 And 2022 The Motley Fool

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)