tax return rejected dependent ssn already used

Whether intentionally or unintentionally someone else has claimed you as a dependent on a 2020 Federal 1040 tax return. For example if your return is rejected because someone else uses your SSN your spouses SSN or your dependents SSN without authorization you may need to print your return.

Rejected Tax Return Common Reasons And How To Fix

Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependents SSN the IRS.

. Rejected due to SSN already used. If your tax return is being rejected because the listed dependents Social Security Number is being used on another tax return and you have verified that the information you have supplied. You prepare your tax return.

It is not uncommon. If you are experiencing significant financial hardship due to the freezing of your refund the IRS Taxpayer Advocate Service can. This rejection is the result of a typo on another return.

Or so you think. If you mail in your. Additionally if you think.

During this process your refund will be frozen. You clear all the e-filing reviews click on the FILE NOW button and you are done. Your electronic filing was rejected by the IRS.

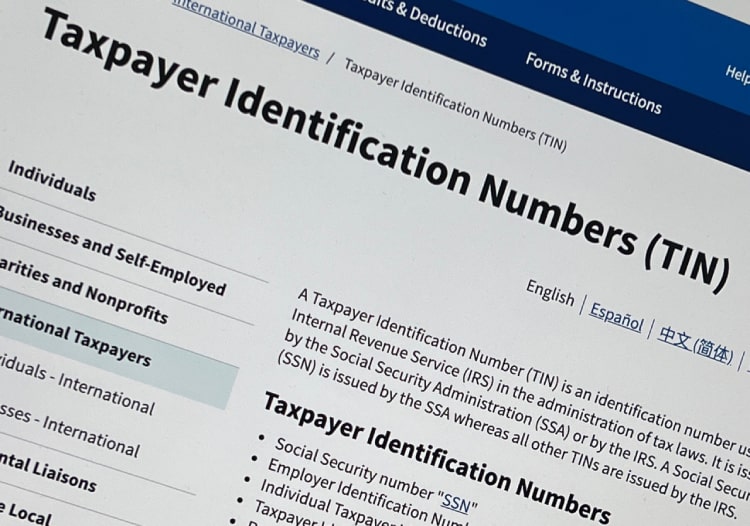

I know I have not filed previously this year. In most cases the taxpayers social security number ssn was entered incorrectly. Then take these steps.

First double check that you meet all of the requirements to claim the dependent. Whether the cause of this rejection is the result of a typo on another. You will not be able to electronically file your.

The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. If someone has stolen your Social Security Number and filed a fraudulent tax return to receive your refund your tax filing will be rejected if you try to e-file. File a paper return.

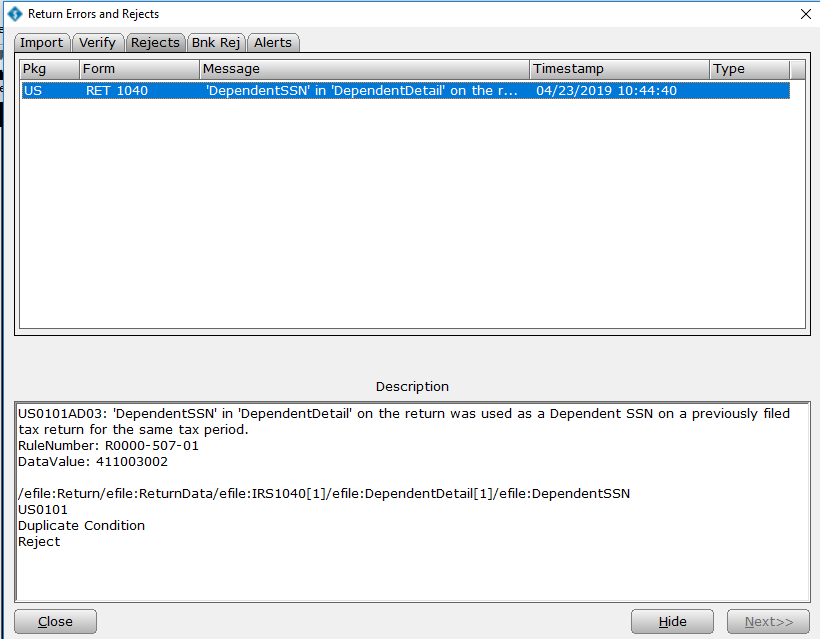

SSN has been used on a previously accepted return. Print out and mail your return claiming your dependent to the IRS. If your return was rejected due to your dependents SSN being used on another return the first thing to do is to verify that you entered the SSN correctly in the return.

Return Rejected due to dependent social being used. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year. If you did not file a Federal return at all this year contact the IRS immediately at 800-829-1040 as an income tax return has been filed using the Primary Taxpayers SSN.

My tax return was rejected for dependent ssn was already used- this is my year to claim my dependent I believe my ex has claimed for this year when she is not eligible for this. I submitted a client return with their dependent daughter. My 1040 was rejected with code R0000-502-001.

I also file the daughters taxes and I. Irs rejected return ssn already used.

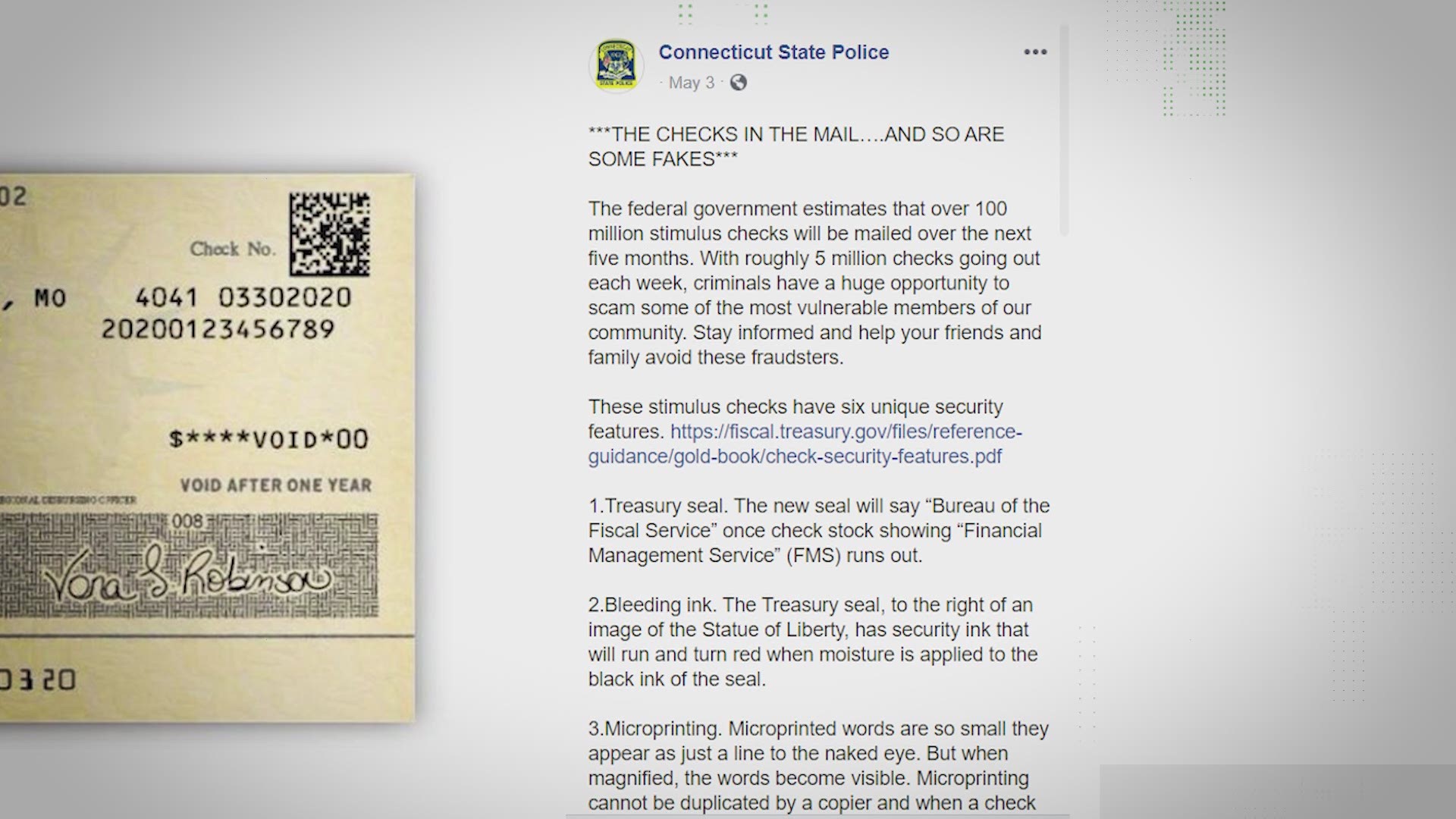

What To Know About The First Stimulus Check Get It Back

6 Times You Should Paper File Your Tax Return Dimercurio Advisors

I M Not Eligible For An Ssn Can I Get An Individual Taxpayer Identification Number Itin Instead Us Immigration Lawyer Buffalo Ny

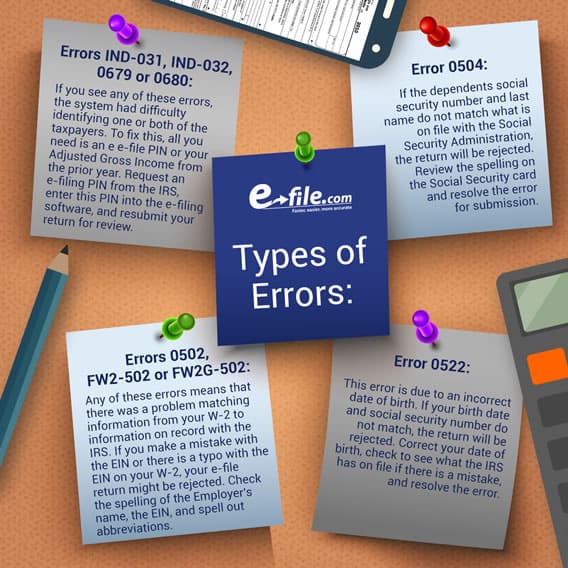

Common Irs Error Reject Codes And Suggested Solutions Taxslayer Pro S Blog For Professional Tax Preparers

Tax Refund Status Is Still Being Processed

Is Your Tax Return Rejected Follow These Steps To Correct It

Irs Tax Notices Explained Landmark Tax Group

How To Fix A Dependent Already Claimed E File Reject Turbotax Support Video Youtube

Irs Form 14039 Guide To The Identity Theft Affidavit Form

What Got Your Tax Return Rejected And What You Can Do About It

Tax Return Rejection Codes By Irs And State Instructions

My Images For Just Lisa Now Intuit Accountants Community

What Got Your Tax Return Rejected And What You Can Do About It

Possible Rejection Reasons When E Filing Taxes E File Com

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support

Stimulus Check 2020 Delays Issues Tax Return Amount Ksdk Com

Irs Identity Theft What To Do If Someone Files Taxes Using Your Ssn

Why Is Your Tax Return Being Rejected Gartzman Tax Law Firm P C The Gartzman Law Firm P C

6 Times You Should Paper File Your Tax Return Dimercurio Advisors