unrealized capital gains tax bill

Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving. A CRUT is a tax exempt account that protects your sale from capital gains taxes.

Senate Democrats Push For Capital Gains Tax At Death With 1 Million Exemption Wsj

The tax will charge a long-term cap gains rates on all unrealized monies for tradeable investments which includes stocks bonds.

. Prohibiting Unrealized Capital Gains Taxation Act. The Secretary of the Treasury including any delegate of the Secretary or any other Federal Government official shall not require or impose the implementation of taxation. Senate Finance Committee Chairman Ron Wyden D.

The Secretary of the Treasury including any delegate of the. The largest part of the tax bill will be upfront. Prohibition on the implementation of new federal requirements to tax unrealized capital gains.

Democrats need to rethink their plan to tax billionaires on their unrealized capital gains which will discourage investment in the US. DEFER 100 OF CAPITAL GAINS TAXES Like an IRA or 401k a CRUT allows you to defer your state and. Mitt Romney R-Utah told.

Of all the many revenue-raising ideas that have bubbled up out of Washington the recent proposal to tax unrealized capital. A tax on unrealized gains would harm the economy. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

WASHINGTONPresident Biden expressed support for a proposal under consideration in the Senate to place an annual income tax on billionaires unrealized capital. The Secretary of the Treasury including any delegate of the. Below are one economists estimates of what the top 10 wealthiest.

Prohibition on the implementation of new federal requirements to tax unrealized capital gains. If you hold an asset for less than one year and sell for a capital gain the difference between your purchase price and your sale price will be subject to short-term capital gains. Prohibiting Unrealized Capital Gains Taxation Act This bill prohibits the Department of the Treasury or any other federal official from imposing a tax on unrealized.

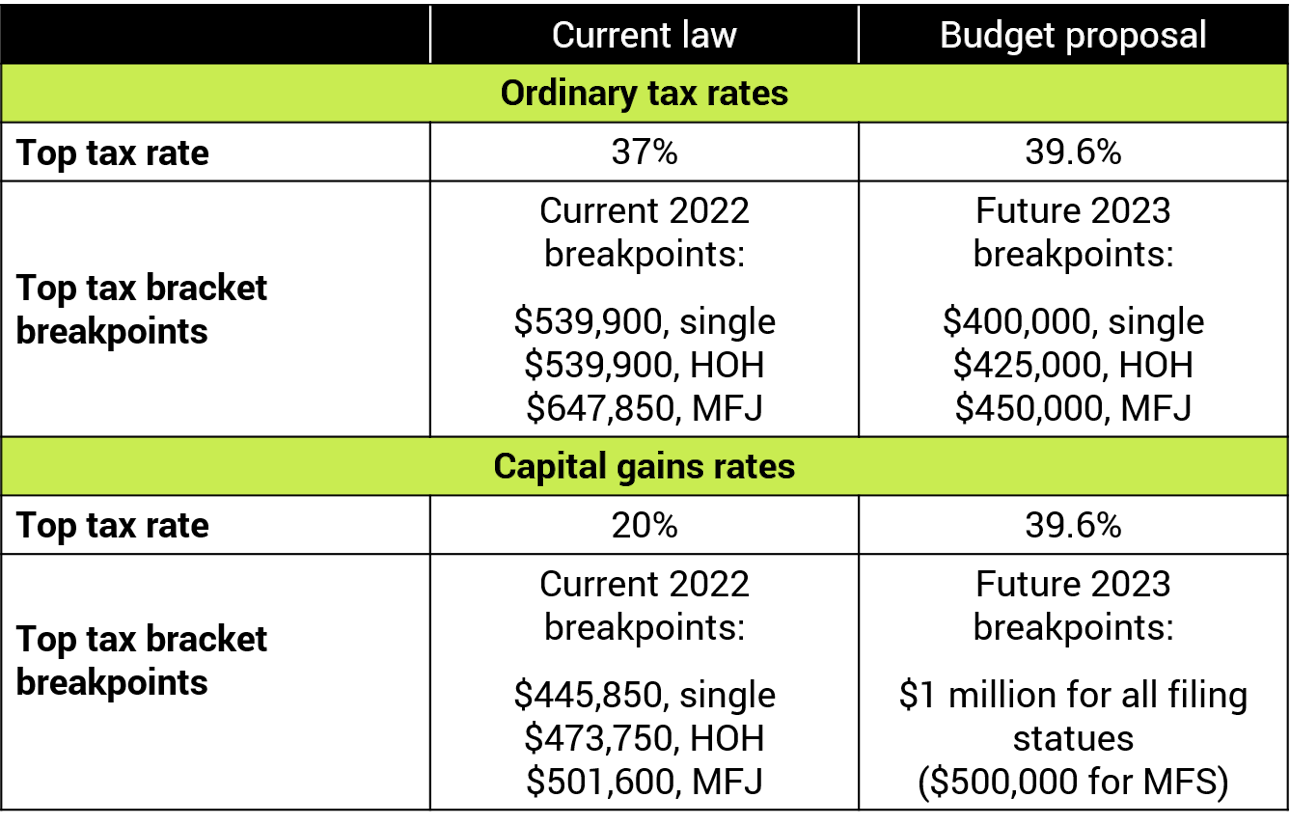

To increase their effective tax rate. How Billionaires Like Musk Could Use Options to Cover the Bill. Biden also called for the top capital gains tax rate to be the same as his top proposed rate on other income at 396.

Wealth Wealth in Stocks Estimated Taxable Gains Tax Owed. Unrealized capital gains tax means if you buy a stock for 100 and it goes up to 500 then back down to 50 you owe taxes on the 400 profit you never made. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

The way its currently structured the tax would affect the richest 700 Americans forcing them to include unrealized gains as part of their annual income. Text for HR5814 - 117th Congress 2021-2022. House Speaker Nancy Pelosi took issue with plans by fellow Democrats to levy a tax on unrealized capital gains to help pay for President Bidens 175 trillion social spending bill.

20 Minimum Tax on Unrealized Gains in Billions Payable in Nine Years.

Strategies For Investments With Big Embedded Capital Gains

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

How Elon Musk Could Pay For A Tax On Unrealized Capital Gains Barron S

Manchin Pans Biden S Proposed Tax On Unrealized Gains Of Wealthy Bloomberg

Let Me Tell You About The Very Rich They Are Different From You And Me Tax Policy Center

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Biden S Better Plan To Tax The Rich Wsj

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Analyzing Biden S New American Families Plan Tax Proposal

Capital Gains Tax What Is It When Do You Pay It

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Democrats Unveil Billionaire S Tax On Unrealized Capital Gains

The Rich Benefit As Democrats Forgo Tax On Unrealized Capital Gains

What The Wyden Proposed Tax On Unrealized Capital Gains May Mean For You

2021 2022 Long Term Capital Gains Tax Rates Bankrate

Proposed Tax On Billionaires Raises Question What S Income The New York Times

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Yellen Describes How Proposed Billionaire Tax Would Work Barron S